Collecting from Refuse-to-Pays aka ‘Nuclear Debtors’

Refuse-to-Pays are some of the most difficult debtors to tackle. I much prefer angry customers because when people are angry, they usually care. If I can calm them down, listen to them, solve their issues; then I’m usually able to collect.

But ‘Refuse-to-Pays’ say things like:

- “Go ahead, get in line, sue me.”

- “Do what you have to do, I’m not paying.”

- “I don’t care.”

Sometimes I confuse them with angry customers. I’ll say something like, “I’m sorry Mr./Ms. Customer, did I make you angry?” And they respond with, “Oh, no. You’re fine. But go ahead and sue me.”

Tough.

When debtors become ‘refuse-to-pays’, it’s often because they don’t know what else to say. They know they can’t argue with your facts, so they pull out their last weapon to avoid paying: “I don’t care”. In a sense, they’ve gone nuclear.

When debtors go nuclear, it reminds me of our love lives.

Remember back in the day when your girlfriends/boyfriends—even spouses—would go nuclear on you. For whatever reason they would dramatically state, “But I don’t love you anymore.” Sometimes it’s real; sometimes it’s a game.

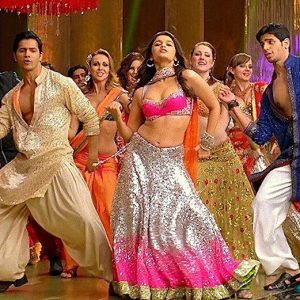

Bollywood movies use this technique a lot. You see the gorgeous woman emphatically tell her gorgeous boyfriend, “But I don’t love you anymore.” You then hear a sharp screech of a violin and a close-up of the boyfriend’s anguished face. He then starts extolling her beauty, how much he loves her, how his family loves her, and all kinds of other compliments; until she relents and says, “Oh, yes, I love you too!”

Bollywood movies use this technique a lot. You see the gorgeous woman emphatically tell her gorgeous boyfriend, “But I don’t love you anymore.” You then hear a sharp screech of a violin and a close-up of the boyfriend’s anguished face. He then starts extolling her beauty, how much he loves her, how his family loves her, and all kinds of other compliments; until she relents and says, “Oh, yes, I love you too!”

Then a cast-of-thousands breaks out in a dance scene. The world returns to balance.

Although the woman went nuclear with her, “But I don’t love you anymore”, she ends in agreement with him. In this case, she was just playing a game as she wanted more attention.

3-Steps: Probe-Agree-Move to Money

Step 1: Probe (don’t dance)

When debtors say, “I don’t care” (and other nuclear statements), it’s often a game. But to determine if it’s a game or not, I recommend you start probing. You have got to get the debtor talking. I usually respond with, “I’m sorry you feel that way. Why is that?” I shut up and listen.

And listen.

And listen.

It can last a long time, but the more questions you ask, the information you get, and the easier it is to connect and counter their payment refusal. Sometimes, just the simple act of listening (paying attention) is enough to get the debtor to pay. In any case, when debtors go nuclear, probe to get them talking.

And, if after you probed, you have decided that the debtor is telling you the truth, then advise him/her that you’re sorry s/he feels that way and you’ll now send the account for legal action. But, if s/he changes their mind, to call you back immediately. Then go to the next account. You can’t win them all.

But, after probing, I find most customers use nuclear statements as games. I then go to Step 2.

Step 2: Agree

When debtors open up and explain their problems, issues, complaints, whatever; don’t fight with them. Instead, just agree. But you don’t have to agree 100%.

Example 1: Let’s say you probed and the debtor tells you s/he is refusing to pay because your bank’s interest rates, charges, whatever are too high.

Don’t fight and say something like, “But sir/madame, our rates are set by the National Bank and all the other banks are charging the same rates.”

Instead, just agree: “I agree the rates and fees seem high. Now, I’d like to work with you to ensure we can stop them from increasing. I may even be able to decrease them, but I need your help too.”

Example 2: Let’s say you probed and the debtor tells you s/he is refusing to pay because your organisation’s staff and processes are rude and totally screwed up.

Don’t fight and say, “Who was rude? What is your proof? When was it? I don’t believe you. We have some of the best staff at this company……..”

Instead, just agree: “I agree we might have a rude staff here and there. I’m sorry you experienced that. I also agree that all of our processes are not perfect. I’d like to get your feedback when we’re done on your suggestions. But first I’d like to work with you to ensure your account gets back-on-track, but I need your help too.”

What is the difficult customer’s initial reaction when you actually agree with their controversial statements? Probably one of shock. They were expecting a fight, but instead they got agreement. And when customers are in shock, they go quiet. Now is the time to take control and move the debtor back to the money.

What is the difficult customer’s initial reaction when you actually agree with their controversial statements? Probably one of shock. They were expecting a fight, but instead they got agreement. And when customers are in shock, they go quiet. Now is the time to take control and move the debtor back to the money.

Step 3: Move to money

After you probe and agree with whatever they say (or at least partially agree), you have hopefully got a lot of information, connected with the debtor, shocked him/her, perhaps showed empathy. Now you are ready to move the debtor back to the money. I find this step the easiest of the three.

But what happens if I probed and they still refuse to talk?

I hope you don’t get too many of these customers each day because they can cause you to lose sleep and hair.

Here are 6 more ideas to crack that nut!:

Here are 6 more ideas to crack that nut!:

- Ask to meet him/her face-to-face. People are usually not so tough in person. And when you do see them, give them something, anything. Coffee, tea, water, crackers, whatever. If the debtor says, “No thanks”, you say, “Well, here just in case you need it later.” GIVE THEM SOMETHING! You want them to feel obligated. Get something in their hands!

Many collectors say, “But Steve, our company is so damn cheap we can’t even offer free coffee.” Fine, give them water. Just give them something!

- Call at a different time. Sometimes they are easier to handle after lunch, but only do this if you are confident you can reach the customer again.

- Use soft words and tone to connect with introverted debtors to get them talking. I use words like ‘help’, ‘protect’, ‘sorry’. I also use their names. Often debtors are tough because they think you’re tough. So, show them you’re human.

As an American trainer based in SE Asia, one of the biggest hurdles collectors have to overcome here is avoid sounding like an uncaring robot and to sound like a caring human. Our debtors are humans. They are paying with their own money, but collectors are collecting their employers’ money. Collectors are workers and they can sound robotic. Many can’t connect with debtors.

- Use your authority / credibility. Humans respect professionals. Use a powerful job title. I like ‘account supervisor’ or ‘credit workout specialist’. Don’t call yourself ‘clerk’ and other lowly job titles. Give yourself some power. Besides your job title, share your experience. Tell the debtor about the thousands of people you have helped. Share your years of experience if you have many years.

Now, when you use authority / credibility, you have got to speak confidently. Don’t sound like Mickey Mouse!

- Use positive or negative stories / examples of debtors whom you have helped or who rejected your help and now regret their decisions. Keep the examples’ demographics similar to the customer so s/he can relate. A positive story has a happy ending; a negative story a sad one. I find using this technique adds peer pressure to the customer and can work sometimes.

- Give the customer compliments, “Mr./Ms. Customer, in the past your account was a great account. You always paid on time. You stayed in contact with us. Thank you for being a great customer. But now the account is 6 months overdue. What’s going on?”

Note: I use the word ‘you’ and ‘your’ in positive situations but avoid it in negative ones. Everyone likes compliments because deep down we’re all insecure. Debtors won’t argue with your compliments. Too often collectors only focus on the immediate negative situation and not on past positive behavior.

Always welcome

Always welcome

Now, let’s say you cracked that tough nut and the customer has finally opened up to you about why s/he refuses to pay. The next step I do is WELCOME his /her response. I say things like:

- “Thank you for sharing that with me.”

- “I appreciate you telling me that.”

Whatever you do, welcome it when s/he opens up. Do not judge, laugh, scold, teach or whatever else when s/he opens up. I’ve had debtors who finally opened up and said, “OK, the reason why I said ‘I give up’ is because I used my savings to buy a car and now I don’t have money for you.”

The collector would respond with, “Buy a car! Mr. Customer, now we are going to sue you.” Such a collector response makes it extremely difficult to work out a payment plan.

Difficult, refuse-to-pay customers aren’t easy, but we can tackle them. They give us stress, but they also teach us a lot. I rarely remember my easy, good paying customers, but I remember just about every customer who refused to pay. They build up your confidence and teach you more than any trainer can teach you.

Wishing you good luck on your nuclear customers (and others). Please share any tips, tweaks, and techniques you use. Together we conquer.

Collecting Creatively,

Steve

Steve is an American trainer based in Malaysia since 1995. He’s the author of Debt Collections: Stir-Fried or Deep-Fried? President of ServiceWinners International Sdn. Bhd. www.servicewinners.com, steve@servicewinners.com

Artwork:

- Motherforlife.com; thedanceclubindia.com; birthdayinspire.com; valleynutgroves.com.au; austin.uli.org/news/6924/